Overview

This project is developed under mentorship of Dr. Fahad Sultan. Dr. Sultan is a professor in computer science at Furman University and we conducted this project as a half-year research project. The project focuses on analyzing and predicting the stock prices of the top 150 companies by dollar volume in the S&P 500 index using LSTM (Long Short-Term Memory) models. The model predicts stock prices and optimizes a portfolio based on these predictions.

Key features of this project include:

- Data extraction and preprocessing from Yahoo Finance.

- Implementation of LSTM models for stock price prediction.

- Optimization of portfolio weights using the Efficient Frontier.

- Performance evaluation against SPY (S&P 500 ETF) and visualization of returns.

Data Collection

- Yahoo Finance: Historical stock data for all companies in the S&P 500 index from 2000-01-01 to 2024-02-19.

- Wikipedia: List of companies in the S&P 500 index used to filter the stock symbols.

Models Used

Long Short-Term Memory (LSTM) Model:

- Stock Price Prediction: Predicts the stock price using historical stock data, adjusting for relevant time-series patterns.

- Portfolio Optimization: Optimizes a portfolio based on predicted stock prices using the Sharpe ratio as the primary metric.

The models are trained on historical data and backtested using recent data to ensure robustness and accuracy in predictions.

Trading Strategy

The trading strategy developed can be broken down in these steps:

- LSTM Predictions Use the Long-Short Term Memory model to predict the stock price of the each stock at the end of the following month.

- Top 15 Stocks Pick out the top 15 best performing stocks for the following month. If there aren't 15 stocks with positve returns, only pick the ones with predicted positive returns.

- Optimize Weights Optimize the weights for the portfolio based on the sharpe ratio. I.e. maximize the sharpe ratio for the portfolio.

- Repeat Repeat for each month.

Results

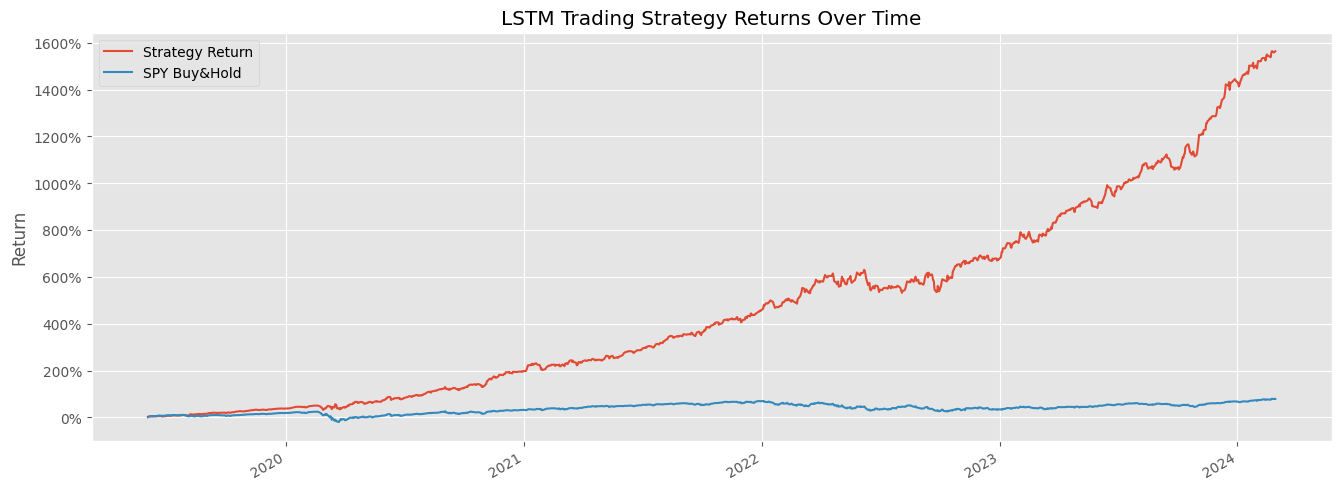

Portfolio Performance

Conclusion

We managed to generate a trading strategy that outperforms the S&P 500 index substainally. I would like to express my gratitude to Professor Sultan for his guidance.

Project Repository

The full code and dataset are available on my GitHub repository.

Contact

For more information or inquiries about this project, please contact me at:

westling01@gmail.com